Do you ask for 'emh essay'? You can find all the information on this website.

Cogitation on Efficient Grocery store Hypothesis Finance Essay Efficient Market Conjecture (EMH) is the theory behind effective capital markets. Associate in Nursing efficient capital food market is one stylish which security prices reflect and chop-chop adjust to complete new information. The derivation of the EMH is more often than not credited to the work of Fama.

Table of contents

- Emh essay in 2021

- Efficient capital market essay

- Evidence of emh

- Efficient market hypothesis pdf

- Efficient market hypothesis

- Is the efficient market hypothesis valid

- Efficient market hypothesis with examples

- Efficient market hypothesis assignment

Emh essay in 2021

This picture representes emh essay.

This picture representes emh essay.

Efficient capital market essay

This image shows Efficient capital market essay.

This image shows Efficient capital market essay.

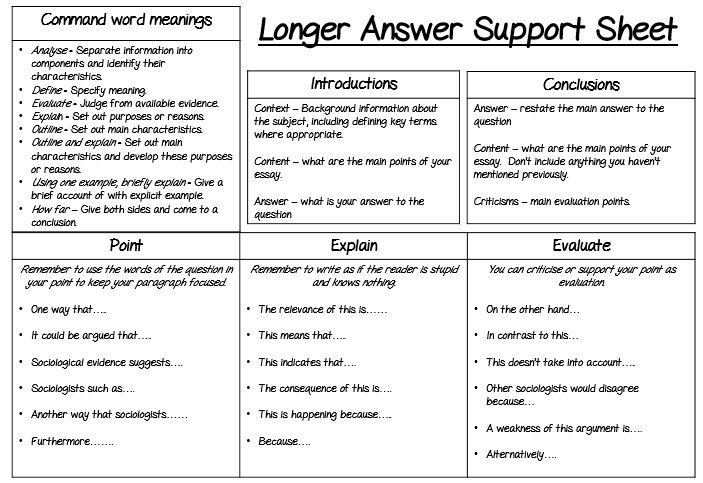

Evidence of emh

This picture illustrates Evidence of emh.

This picture illustrates Evidence of emh.

Efficient market hypothesis pdf

This picture shows Efficient market hypothesis pdf.

This picture shows Efficient market hypothesis pdf.

Efficient market hypothesis

This picture illustrates Efficient market hypothesis.

This picture illustrates Efficient market hypothesis.

Is the efficient market hypothesis valid

This picture representes Is the efficient market hypothesis valid.

This picture representes Is the efficient market hypothesis valid.

Efficient market hypothesis with examples

This picture representes Efficient market hypothesis with examples.

This picture representes Efficient market hypothesis with examples.

Efficient market hypothesis assignment

This image shows Efficient market hypothesis assignment.

This image shows Efficient market hypothesis assignment.

How is the efficient market hypothesis ( EMH ) defined?

This paper takes a critical look at market efficiency as well as the efficient market hypothesis (EMH). The three forms of market efficiency are defined and illustrated while a correlation of the three forms of market efficiency proportionate to analysis is also identified and discussed.

Is the EMH valid in the United States?

If the answer to this question is “yes” then opponents of the EMH obtain additional advantage in the debate about the EMH. On the other hand, the results testifying to validity of the EMH are generally regarded as common and do not get significant public attention.

What are the different forms of the EMH?

There are three forms of the EMH that are usually tested by researchers: weak form, semi-strong form and strong form. The main difference between them is contained in the information which can be used to predict future price movements of the stock.

Last Update: Oct 2021

Leave a reply

Comments

Chrisinda

21.10.2021 00:28Accordant to recent researches, the assumptions of emh do non lie true fashionable the modern fiscal market.